출처 : https://techcrunch.com/2018/12/11/fintech-startup-plaid-raises-250m-at-a-2-65b-valuation/

TechCrunch New York의 hackathon에서 제품이 무대에 선보인 이후 5 년 동안 Plaid는 금융 기술의 진화에 가장 중요한 공헌자 중 하나이자 레이더 아래에서 가장 많이 기여한 업체 중 하나로 부상했습니다.

지금까지는. 이 회사는 오늘 유명한 벤처 캐피털리스트와 인터넷 트렌드 의 저자 인 Mary Meeker 가 이끄는 2 억 5 천만 달러의 시리즈 C 투자를 발표했다. Mary Meeker는 거래의 일환으로 이사회에 참여할 예정이다. 회사 측근에 따르면이 기금은 26 억 5 천만 달러에 평가됐다. Meeker의 투자는 2010 년부터 Meeker가 파트너였던 Kleiner Perkins의 성장 펀드에서 나왔습니다. 그녀가 모금중인 10 억 달러 이상의 솔로 펀드 에서 나온 것이 아닙니다 .

새로운 투자자 Andreessen Horowitz,Index Ventures, Norwest Venture Partners 및 Coatue Management도 참여했으며 기존 투자자 인 Goldman Sachs, NEA and Spark Capital. The financing brings Plaid’s total raised to $310 million and provides a major boost to its valuation, which was just over $200 million with its 2016 Series B.

Making money easier for everyone

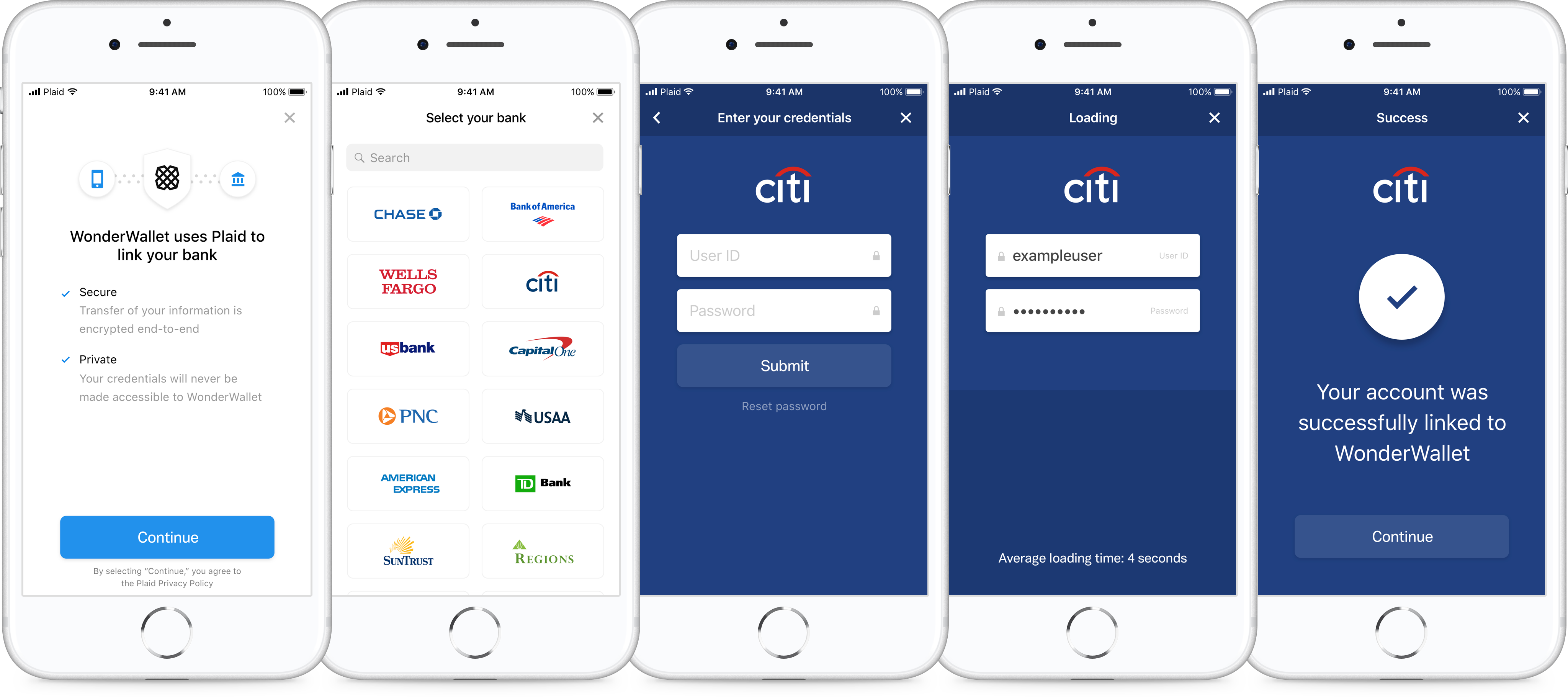

Plaid builds infrastructure that allows a consumer to interact with their bank account on the web through a number of third-party applications, like Venmo, Robinhood, Coinbase, Acorns and LendingClub. The San Francisco-based startup has integrated with 10,000 banks in the U.S. and Canada and says 25 percent of people living in those countries with bank accounts have linked with Plaid through at least one of the hundreds of apps that leverage Plaid’s application program interfaces (APIs) — an increase from 13 percent last year.

The platform allows companies to create financial services applications without having to hire their own team of engineers to build out a tool that connects apps to its users’ bank accounts, something Plaid’s founders themselves lacked when they set out to build a fintech startup years ago. Plaid was founded by a pair of former Bain consultants, William Hockey and Zach Perret, the chief technology officer and chief executive officer, respectively, in 2012.

“We were always really infatuated with the concept of financial services,” Hockey told TechCrunch. “We thought it had so much power to impact and improve people’s lives but at the time it really wasn’t … We quickly realized building financial services was almost impossible to do because there wasn’t the tooling or the infrastructure, so we turned around and started building that infrastructure.”

Plaid closed a $44 million Series B in mid-2016 and has since seen its valuation increase more than tenfold. On top of that, it doubled its customer base this year, launched in Canada — its first market outside the U.S. — opened its third office, expanded its overall headcount to 175 employees and debuted a digital mortgage product called Assets.

Hockey and Perret say the new funding will be used to continue expanding the team in San Francisco, Salt Lake City and New York. Plaid, given how essential its tools are to any technology companies that deals with payments in any fashion, which these days is the vast majority of businesses, is a company to watch going into 2019.

"우리는 우리의 장기 목표를 생각할 때 모든 사람이 돈을 쉽게 벌고 싶습니다."라고 Perret는 TechCrunch에 말했습니다. "우리는 모든 사람들이 이러한 단순하고 직관적 인 디지털 방식의 재정적 삶을 영원히 살기를 바라고 있으며 이는 우리 공간과 이러한 커다란 재능있는 기술 혁신가들을 지원한다는 것을 의미합니다. 우리는 소비자들이 훌륭한 재정적 재정적 경험을 창출 할 수 있도록 도와 주면서 소비자들이보다 단순한 재정적 삶을 누릴 수 있기를 바랍니다. "